Grade 11 - More Exercises.

Financial Documents, tariffs, accounts, bills, rates.

1. A certain Municipality has the following rates forthe consumption of household water :

[ The consumption is determined by rounding up the reading to the next whole number of

kl used. Thus, 7,5 kl is rounded up to 8 kl]. VAT at 14% is added :

| |

|

| |

| From (kl) |

To (kl) |

Tariff per kiloliter (R) |

From (kl) |

To (kl) |

Tariff per kiloliter (R) |

| 0 kl |

6,00 kl |

free |

6 kl |

19 kl |

R2,00 |

| 20 kl |

39 kl |

R2,40 |

40 kl |

59 kl |

R3,50 |

| 60 kl |

79 kl |

R4,50 |

80 |

and more |

R7,00 |

|

1.1

A household consumes 18 kl of water.

1.1.1

What is the tariff for this consumption?

1.1.2

Calculate the amount payable. Show all your calculations.

1.2

Another consumption is 38,12 kl. Calculate the amount due. Show all your calculations.

1.3

An account for R235,65 is rendered for a consumption of 75 kl. Test the correctness of

the account. Show all your calculations.

2.

John compiles the following budget :

| |

|

| |

| Income (R) |

|

|

Expenses (R) |

|

| Salary |

16 600 |

|

House-rent |

5 800 |

| |

|

|

Food |

5 250 |

| |

|

|

Clothes |

1 600 |

| |

|

|

Motor instalment |

1 760 |

| |

|

|

Motor maintenance |

940 |

| |

|

|

Entertainment |

1 600 |

| |

|

|

Save |

600 |

| Total |

16 600 |

|

Total |

|

|

2.1

Determine John's expenses. Can he afford all his expenses?

2.2

Suppose that he saves nothing. Does his budget balance? What can he still do to balance

his budget?

2.3

He decides to save R300. What can he do to balance his budget now?

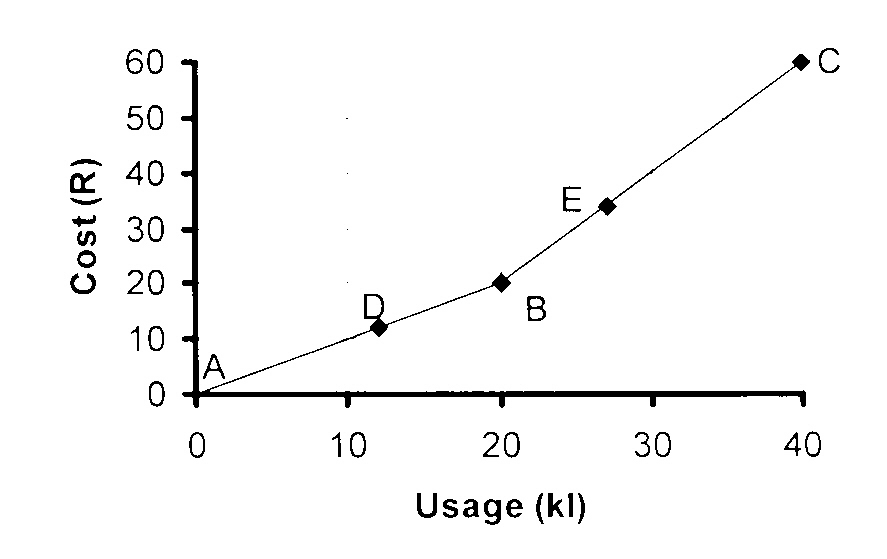

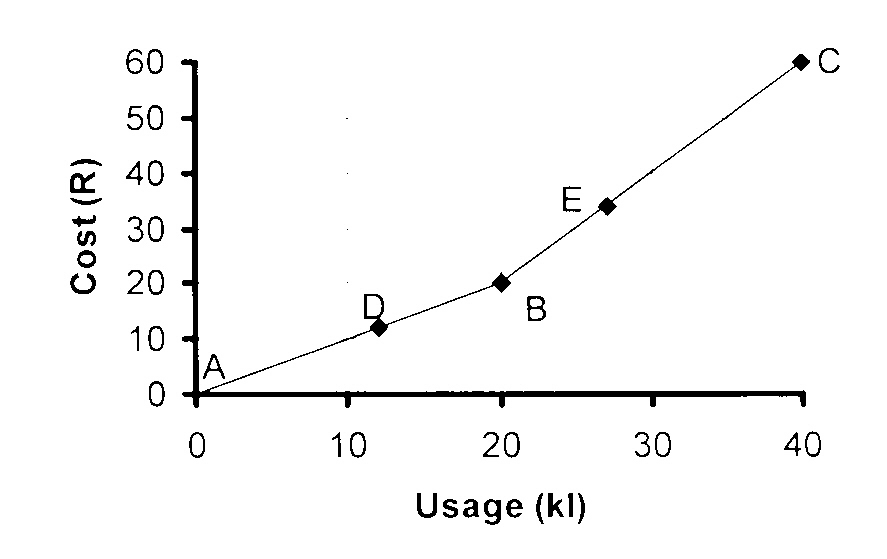

3.

A certain Municipality has the following rates for house-hold water consumption :

from 0 to 20 kl - R1/kl and from 21 to 40 kl - R2 / kl

3.1

Complete the following table :

| |

| Consumption (kl) |

0 |

10 |

20 |

21 |

30 |

40 |

| Cost (R) |

|

|

|

|

|

|

|

3.2

Draw a graph to represent the data.

3.3

What is the minimum cost for consumption in the interval 21 kl to 40 kl?

3.4

What is the maximum cost for consumption in the interval 0 kl to 20 kl?

3.5

Explain the form of your graph of a consumption from 0 kl to a consumtion of 20 kl.

3.6

Estimate the coordinates of the point when the consumption is 12 kl. Mark the point D.

3.7

Estimate the coordinates of the point when the consumption is 27 kl. Mark the point E.

3.8

Now calculate the coordinates of point D.

4.

The accompanying graph shows the cost

levied by a certain Municipality for the

consumption of house-hold water.

4.1

Estimate the cost if the consumption is 12 kl

(point D) and estimate the consumption if the

cost is R76 (point E)

4.2

What is the maximum cost for a consumption

of 30 kl?

4.3

What is the minimum cost for a consumption

of 10 kl ?

4.4

The coordinates of point B is (20 ; 20) and

the coordinates of point C is (40 ; 100). Use this information to calculate the cost per

kiloliter for the interval 0 kl to 20 kl and from 20 kl to 40 kl.

4.5

Use your answers in 4.4 to test the accuracy of your estimates in 4.1.

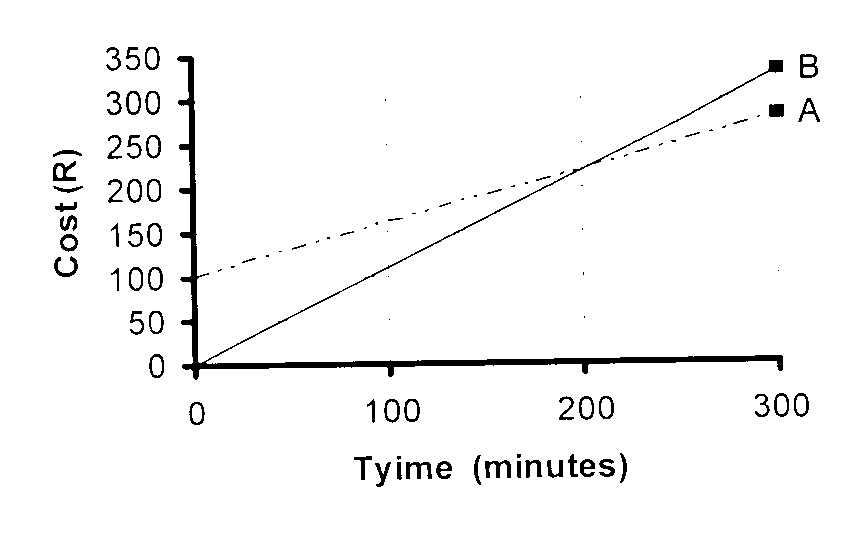

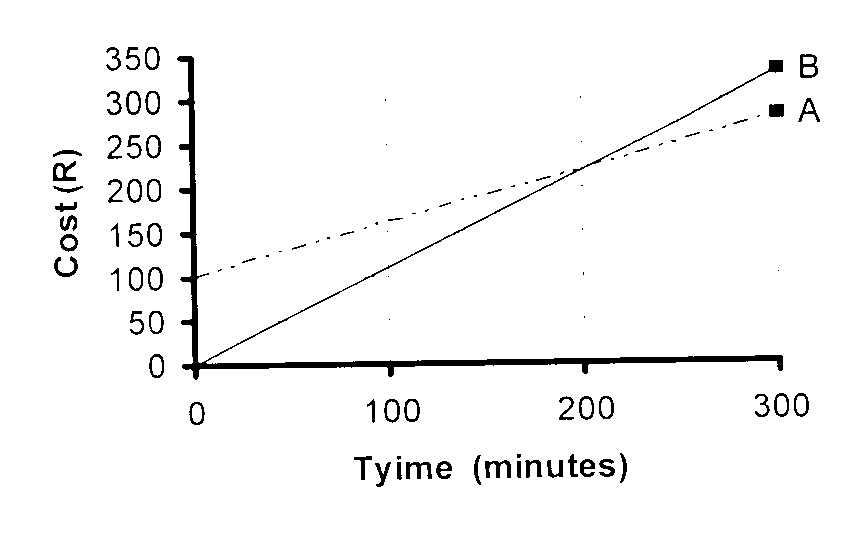

5.

The accompnaying graph shows the cost of

two contracts of a cellphone firm.

5.1

Where and why does the graph of

contract B begin?

5.2

Where and why does the graph of

contract A begin?

5.3

Which of the two comtracts have the

greater cost per minute? Explain.

5.4

Estimate the cost for both contrackts if the

time = 80 minutes.

5.5

Estimate the time if the cost of contract B is R121.

5.6

Where do the two graphs intersect? What does this imply?

5.7

Calculate the cost per minute of both contracts if the cost of contract A is R250 and that

of contract B is R275 if the time = 250 minute.

5.8

Ust the answers in 5.7 to test the accuracy of your estimations in 5.4 and 5.5.

Show all the calculations.

5.9

When is the cost of contract B greater than that of contract A?

5.10

Which contrak, A or B, will you recommend to a person that uses less than 150 minutes per

month? Supply reasons.

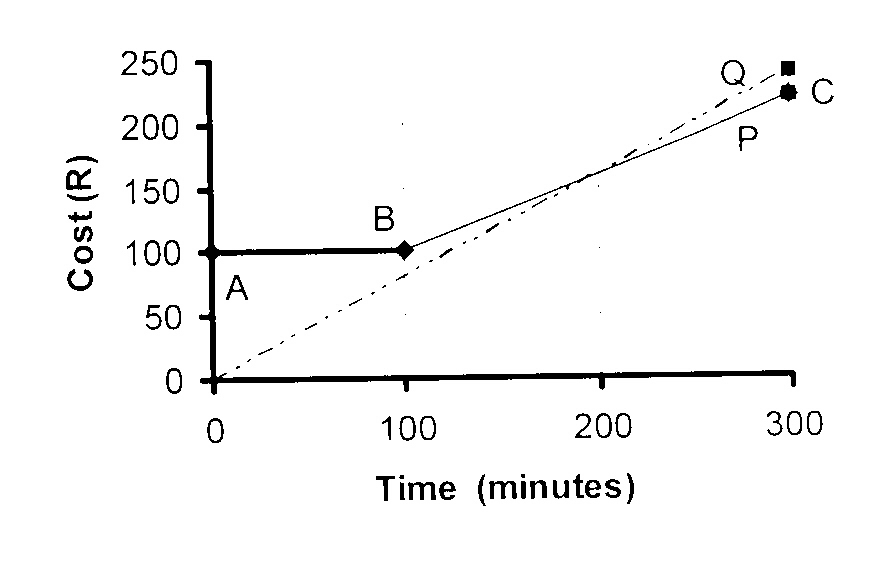

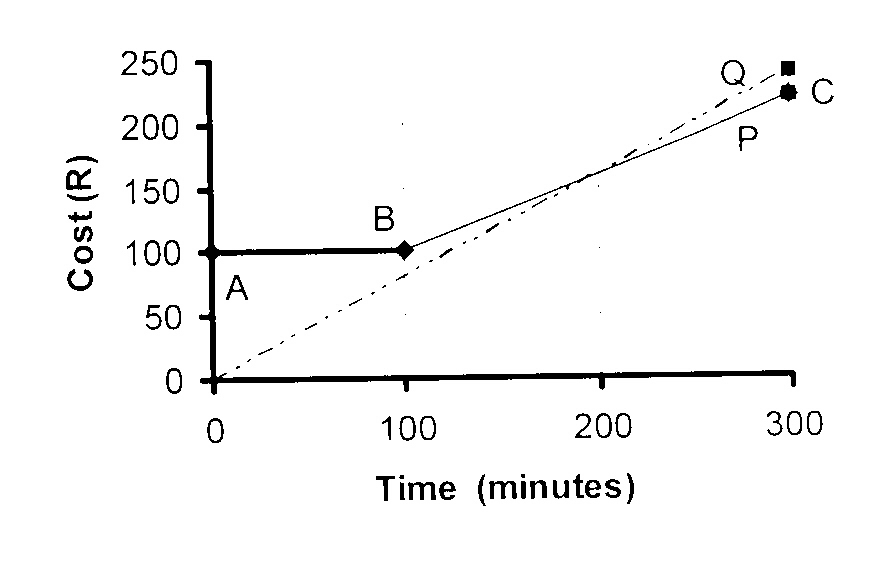

6.

The accompanying graph shows the cost of

two contracts, P and Q, of

cell phone provider.

6.1

The graph of contract P is given by the

line ABC. Why does the first part, AB, not

begin in the origin? What does this mean?

6.2

Describe and explain the part BC.

6.3

Does the graph of contract Q represent an

increasing relation? Explain.

6.4

Which contract, P or Q, is the cheaper for

usage of leaa than 100 minutes per month? Explain.

6.5

Which contract, P or Q, is the cheaper for usage of more than 210 minutes per

month? Explain.

6.6

Which contract, P or Q, has the lowest tariff per minute? Explain.

7.

Study the following account of XYZ Municipality.

7.1

Write down the Municipality's

phone number.

7.2

Write down the Municipality's

postal address.

7.3

What is the date of the account?

7.4

Who is the addressee?

7.5

Why does the amount in the

column "Payment received"

have a negative sign?

7.6

How much water has been used?

7.7

Is the amount for water usage

correct? Show your

calculations.

7.8

Also calculate the amount for

using electricity. Show

all your calculations.

7.9

Calculate the amount in the last

row marked with a ###.

7.10

Are there any other mistakes on

the account? Show all your

calculations to rectify it.

7.11

At what parcentage is the

annual levy added?

| XYZ Municipality |

| 13 Meandering Street

P.O. Box 34

Phone : 001 968 0001 |

| Waterloo

Waterloo

Fax: 001 968 0002 |

| 061208

061208 |

|

| Mr. J Williams

Account for April 2015 |

| P.O. Box 11

Date : 30/04/2015 |

| Waterloo

Due date 14 / 05 / 2015 |

| 061208

Account number : 16169 |

|

| Description |

Charge |

Amount |

VAT |

Amount |

| Brought forward |

|

|

|

729,75 |

| Payment received |

|

|

|

-729,75 |

| Water |

## |

77,30 |

## |

165,42 |

| Elektricity |

## |

## |

144,54 |

1 176,94 |

| Refuse removal |

|

50,00 |

7,00 |

57,00 |

| Sewerage charge |

53 |

63,60 |

8,90 |

72,50 |

| Annual levy |

|

|

|

373,46 |

| Totals |

|

### |

171,26 |

1 845,32 |

| |

| Meter readings |

Property Information |

| Type |

Previous |

Current |

Stand |

0236 |

| Water |

3568 |

3621 |

Size (ha) |

0,125 |

| Elektricity |

10524 |

11236 |

Value |

925 000 |

| |

|

|

Annual levy |

3 931,20 |

| |

| Notes : 1. Water rates : 0 kl to 6 kl - free |

|

7 kl to 29 kl - R1,10 / kl |

|

30 kl to 49 kl - R1,70 / kl |

|

50 kl and more - R4,50 / kl |

|

2. Elektricity rates : R1,45 / unit |

|

3. Arrears : Interest is added at 20% p.a. on |

|

overdue accounts and late payments. |

|

|

8.

Study the bank statement of

a current account.

8.1

Write down the date and the

number of the statement.

8.2

Why is the "Brought forward"

balance shown with a

negative sign?

8.3

Why are the amounts shown in

the Debit column shown as

negative numbers?

8.4

Calculate the balance after

AtoZ Services paid the salary.

What and why is the sign

of the Balance?

8.5

Calculate the Balance on 04:06.

Explain your answer.

8.6

Why is the amount shown in the

Credit column positive?.

8.7

Calculate the Balance on 04:18

8.8

Calculate the Balance on 04:30 after

the Service fees have been added.

8.9

Calculate the interest on the

overdrawn account.

8.10

Calculate the Closing Balance

on 04:30

| The New Bank |

| P.O. Box 201

Phone: 808 908 1001

2 May 2008 |

| Stayhere

Fax: 808 908 1002

Invoice number : 121 |

| 081908 |

|

| Mr. S. Stephens |

| P.O. Box 108 |

| Stayhere |

| 081908 |

|

| Statement / Tax Invoice |

| VeryEasy

Account number : 34501261 |

| |

| Details |

Date |

Debits |

Credits |

Balance |

| Brought forward |

|

|

|

4,802.91− |

| AtoZ Services - salary |

04.01 |

|

11,200.00 |

## |

| Instament - life insurance |

04.01 |

641.00− |

|

## |

| Instalment - insurance |

04.01 |

387.75− |

|

5,368.34 |

| SafetyFirst |

04.01 |

326.00− |

|

5,042.34 |

| The New Bank - instalment motor car |

04.02 |

2,080.00− |

|

2,962.34 |

| TakeCare Garage |

04.05 |

1,421.00− |

|

1,541.34 |

| BuyHere |

04.06 |

3,380.54− |

|

## |

| Cash withdrawn |

04.10 |

1,200.00− |

|

3,039.20− |

| TakeCare Garage |

04.12 |

927.00− |

|

3,966.20− |

| Transfer from Account 12300075 |

04:18 |

|

1,500.00 |

## |

| BuyHere |

04.26 |

1,804.12− |

|

4,270.32− |

| Service Fee |

04:30 |

99:00− |

|

## |

| Interest - overdrawn account |

04:30 |

## |

|

## |

| Rates due as on April 1, 2005 |

| |

| Interest is added to overdrawn accounts at the rate of |

| 13,5% p.a. and is compounded monthly. |

|

| |

| Please check alle transactions and report any differences. |

|

| The following information for question 9 : |

| 1. Tax Rates for individuals : |

| Taxable Income |

Rates of Tax |

| 0.00 —

122 000 |

18% of each Rand |

| 122 001 —

195 000 |

21 960 + 25% of the amount over 122 000 |

| 195 001 —

270 000 |

40 210 + 30% of the amount over 195 000 |

| 270 001 —

380 000 |

62 710 + 35% of the amount more than 270 000 |

| 2. Each tax payer receives a deductable primary rebate of R8 280.00 per year. |

| 3. Overtime-rates: overtime 1.5 is calculated at the rate 1,5 times normal rate. |

|

overtime 2 is calculated at the rate of twice the normal rate. |

|

| ABC Works |

PAY SLIP |

| P.O. Box 198 Phone: 111 010 1000 |

| Goaway

Fax: 111 010 1001

Date: 2009/08/30 |

| 80021 |

|

| Name : Jack Hammer |

Employee code : W115 |

| Account number : 00501623 |

Mechanic |

| |

Tariff: R85,00 per hour |

| Description |

Wages |

Deductions |

| Salary |

13,200.00 |

Tax |

|

| Overtime 1,5 - 10 hours |

|

UIF |

|

| Overtime 2 |

765.00 |

Pension |

198.00 |

| |

|

Welfare |

85.25 |

| |

|

Trade union |

165.00 |

| |

|

Savings plan |

500.00 |

| |

|

BuyHere |

1,516.88 |

| Total |

|

Total |

|

| Monthly Income |

|

|

| Gross |

|

|

|

| Deductions |

|

|

|

| Net |

|

|

|

|

9.

Study the accompanying pay-slip and

then answer the questions that follow :

9.1

Calculate Jack's earnings

for Overtiem 1.5

9.2

Calculate the number of hours

that Jack worked on Overtime 2.

9.3

Calculate Jack's total wages

for the month.

9.4

Assume that Jack has this income

every month. Calculate the Income

Tax that he has to pay for the

year and the monthly deduction.

9.5

Every month Jack has to pay 1%

of his Salary to the UIF.

Calculate Jack's contribution.

9.6

What percentage of his Salary

is deducted for Pension?

9.7

Calculate the total deductions.

9.8

Calculate Jack's net wages.