A certain Municipality has the following rates for the consumption of household water.

[ The consumption is determined by rounding up the reading to the next whole number of kl used.

Thus, 7,5 kl is rounded up to 8 kl].

VAT at 15% is added :

[ The consumption is determined by rounding up the reading to the next whole number of kl used.

Thus, 7,5 kl is rounded up to 8 kl].

VAT at 15% is added :

| From, kℓ | To, kℓ | Tariff per kℓ (R) | From, kℓ | To, kℓ | Tariff per kℓ (R) | |

| 0 | 6 | free | 40 | 59 | 3,50 | |

| 6 | 19 | 2,00 | 60 | 79 | 4,50 | |

| 20 | 39 | 2,40 | 80 | and more. | 7,00 |

1.1 A household consumes 18 kℓ of water.

1.1.1 What is the tariff for this consumption? A 1.1.1

1.1.2 Calculate the amount payable. Show all

your calculations. A 1.1.2

1.3 An account for R235,65 is rendered for

a consumption of 75 kℓ. Test the

correctness of the account.

Show all your calculations. A 1.3

1.1.1 What is the tariff for this consumption? A 1.1.1

1.1.2 Calculate the amount payable. Show all

your calculations. A 1.1.2

1.3 An account for R235,65 is rendered for

a consumption of 75 kℓ. Test the

correctness of the account.

Show all your calculations. A 1.3

John compiles the following budget :

| Income | Rand | Expenses | Rand | |

| Salary | 16 000 | House-rent | 5 800 | |

| Food | 5 250 | |||

| Clothes | 1 600 | |||

| Motor instalment | 1 760 | |||

| Motor maintenance | 940 | |||

| Entertainment | 1 600 | |||

| Save | 600 | |||

| Total | Total |

2.1 Determine John's expenses. Can he afford all his expenses? A 2.1

2.2 Suppose that he saves nothing. Does his budget balance? What can he still do to

balance his budget? A 2.2

2.3 He decides to save R300. What can he do to balance his budget now? A 2.3

2.2 Suppose that he saves nothing. Does his budget balance? What can he still do to

balance his budget? A 2.2

2.3 He decides to save R300. What can he do to balance his budget now? A 2.3

A certain Municipality has the following rates for house-hold water consumption :

from 0 to 20 kℓ - R1/kℓ and from 21 to 40 kℓ - R2 / kℓ

3.1 Complete the following table :

from 0 to 20 kℓ - R1/kℓ and from 21 to 40 kℓ - R2 / kℓ

3.1 Complete the following table :

| Consumption (kℓ) | 0 | 10 | 20 | 21 | 30 | 40 |

| Cost (R) |

3.2 Draw a graph to represent the data. A 3.2

3.3 What is the minimum cost for consumption in the interval 21 kℓ to 40 kℓ? A 3.3

3.4 What is the maximum cost for consumption in the interval 0 kℓ to 20 kℓ? A 3.4

3.5 Explain the form of your graph of a consumption from 0 kℓ to a consumtion of 20 kℓ. A 3.5

3.6 Estimate the coordinates of the point when the consumption is 12 kℓ. Mark the point D. A 3.6

3.7 Estimate the coordinates of the point when the consumption is 27 kℓ. Mark the point E. A 3.7

3.8 Now calculate the coordinates of point D. A 3.8

3.3 What is the minimum cost for consumption in the interval 21 kℓ to 40 kℓ? A 3.3

3.4 What is the maximum cost for consumption in the interval 0 kℓ to 20 kℓ? A 3.4

3.5 Explain the form of your graph of a consumption from 0 kℓ to a consumtion of 20 kℓ. A 3.5

3.6 Estimate the coordinates of the point when the consumption is 12 kℓ. Mark the point D. A 3.6

3.7 Estimate the coordinates of the point when the consumption is 27 kℓ. Mark the point E. A 3.7

3.8 Now calculate the coordinates of point D. A 3.8

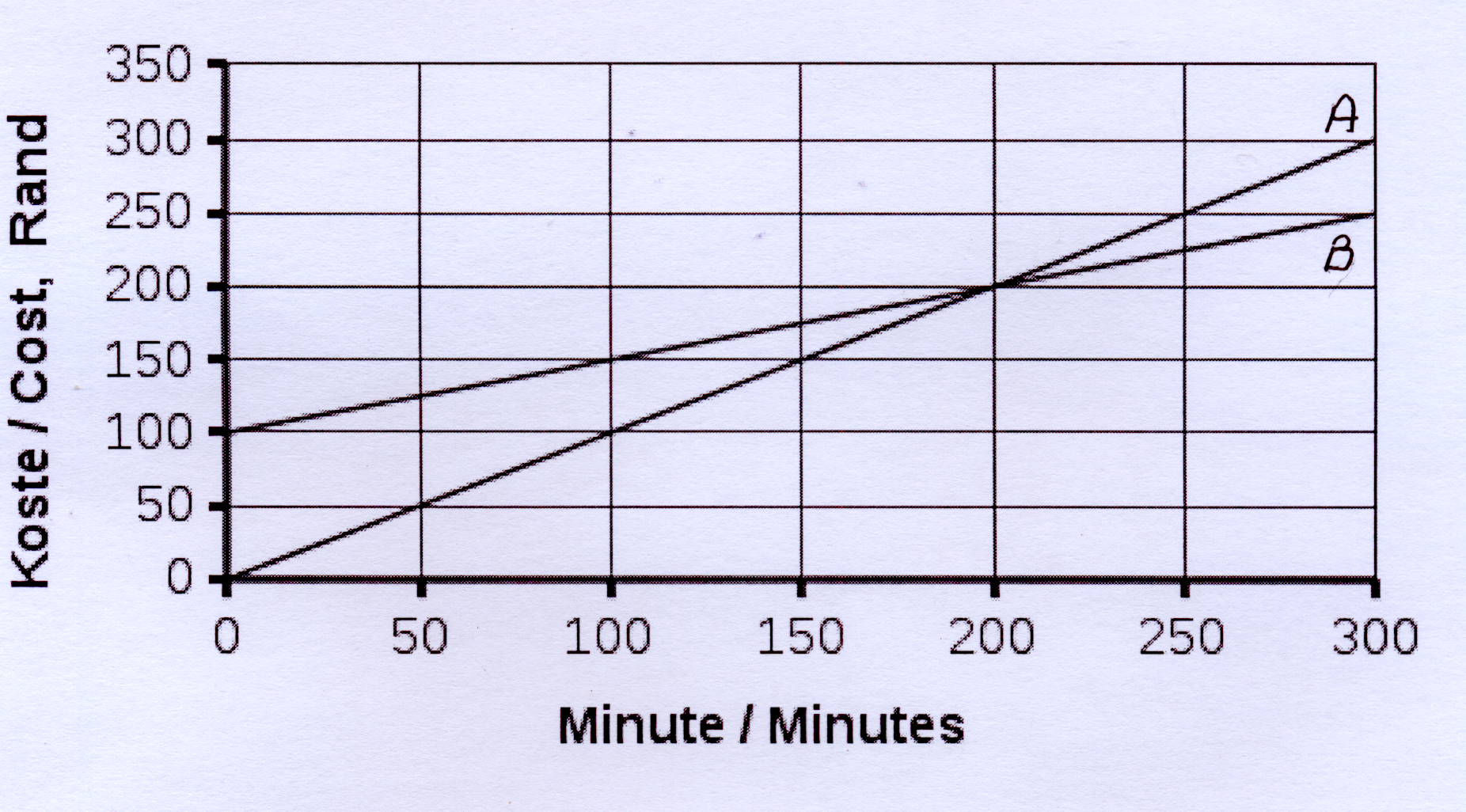

The accompnaying graph shows the cost of two

contracts of a cellphone firm.

4.1 Where and why does the graph of

contract B begin? A 4.1

4.2 Where and why does the graph of

contract A begin? A 4.2

4.3 Which of the two contracts have the

greater cost per minute? Explain. A 4.3

4.4 Estimate the cost for both contracts

if the time = 80 minutes. A 4.4

4.5 Estimate the time if the cost of

contract B is R121. A 4.5

contracts of a cellphone firm.

4.1 Where and why does the graph of

contract B begin? A 4.1

4.2 Where and why does the graph of

contract A begin? A 4.2

4.3 Which of the two contracts have the

greater cost per minute? Explain. A 4.3

4.4 Estimate the cost for both contracts

if the time = 80 minutes. A 4.4

4.5 Estimate the time if the cost of

contract B is R121. A 4.5

4.6 Where do the two graphs intersect? What does this imply? A 4.6

4.7 Calculate the cost per minute of both contracts if the cost of contract A is R250 and that

of contract B is R275 if the time = 250 minute. A 4.7

4.8 Use the answers in 4.7 to test the accuracy of your estimations in 4.4 and 4.5. Show

all the calculations. A 4.8

4.9 When is the cost of contract B greater than that of contract A? A 4.9

4.10 Which contract, A or B, will you recommend to a person that uses less than

150 minutes per month? Supply reasons. A 4.10

4.7 Calculate the cost per minute of both contracts if the cost of contract A is R250 and that

of contract B is R275 if the time = 250 minute. A 4.7

4.8 Use the answers in 4.7 to test the accuracy of your estimations in 4.4 and 4.5. Show

all the calculations. A 4.8

4.9 When is the cost of contract B greater than that of contract A? A 4.9

4.10 Which contract, A or B, will you recommend to a person that uses less than

150 minutes per month? Supply reasons. A 4.10

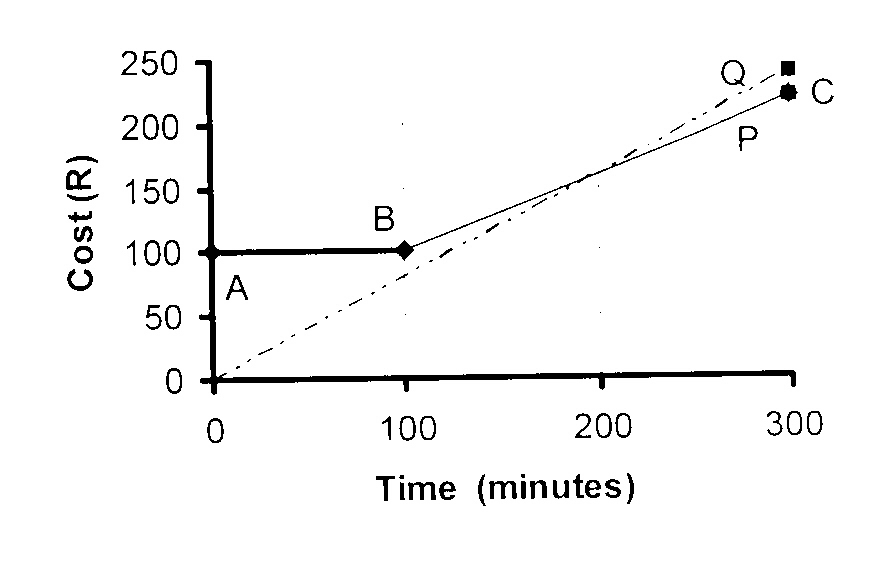

The accompanying graph shows the cost of

two contracts, P and Q, of a cell phone provider.

5.1 The graph of contract P is given by the

line ABC. Why does the first part, AB,

not begin in the origin? What does

this mean? A 5.1

5.2 Describe and explain the part BC. A 5.2

5.3 Does the graph of contract Q

represent an increasing relation?

Explain. A 5.3

5.4 Which contract, P or Q, is the cheaper

for usage of less than 100 minutes

per month? Explain. A 5.4

5.5 Which contract, P or Q, is the cheaper

for usage of more than 210 minutes

per month? Explain. A 5.5

5.6 Which contract, P or Q, has the

lowest tariff per minute? Explain. A 5.6

two contracts, P and Q, of a cell phone provider.

5.1 The graph of contract P is given by the

line ABC. Why does the first part, AB,

not begin in the origin? What does

this mean? A 5.1

5.2 Describe and explain the part BC. A 5.2

5.3 Does the graph of contract Q

represent an increasing relation?

Explain. A 5.3

5.4 Which contract, P or Q, is the cheaper

for usage of less than 100 minutes

per month? Explain. A 5.4

5.5 Which contract, P or Q, is the cheaper

for usage of more than 210 minutes

per month? Explain. A 5.5

5.6 Which contract, P or Q, has the

lowest tariff per minute? Explain. A 5.6

Study the following account of XYZ Municipality.

provider.

6.1 Write down the Municipality's phone

number. A 6.1

6.2 Write down the Municipality's postal

postal address. A 6.2

6.3 What is the date of the account? A 6.3

6.4 Who is the addressee? A 6.4

6.5 Why does the amount in the

column "Payment received" have

a negative sign? A 6.5

6.6 How much water has been used? A 6.6

6.7 Is the amount for water usage

correct? Show your calculations. A 6.7

6.8 Also calculate the amount for using

electricity. Show all

your calculations. A 6.8

6.9 Calculate the amount in the last

row marked with ###. A 6.9

6.10 Are there any other mistakes on

the account? Show all your

calculations to rectify it. A 6.10

6.11 At what parcentage is the

annual levy added? A 6.11

provider.

6.1 Write down the Municipality's phone

number. A 6.1

6.2 Write down the Municipality's postal

postal address. A 6.2

6.3 What is the date of the account? A 6.3

6.4 Who is the addressee? A 6.4

6.5 Why does the amount in the

column "Payment received" have

a negative sign? A 6.5

6.6 How much water has been used? A 6.6

6.7 Is the amount for water usage

correct? Show your calculations. A 6.7

6.8 Also calculate the amount for using

electricity. Show all

your calculations. A 6.8

6.9 Calculate the amount in the last

row marked with ###. A 6.9

6.10 Are there any other mistakes on

the account? Show all your

calculations to rectify it. A 6.10

6.11 At what parcentage is the

annual levy added? A 6.11

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Study the bank statement of a current account.

7.1 Write down the date and the number

of the statement. A 7.1

7.2 Why is the "Brought forward" balance

shown with a negative sign? A 7.2

7.3 Why are the amounts shown in the

Debit column shown as

negative numbers? A 7.3

7.4 Calculate the balance after

AtoZ Services paid the salary. What and

why is the sign of the Balance? A 7.4

7.5 Calculate the Balance on 04.06.

Explain your answer. A 7.5

7.6 Why is the amount shown in the

Credit column positive? A 7.6

7.7 Calculate the Balance on 04.18. A 7.7

7.8 Calculate the Balance on 04.30 after

the Service fees have been added. A 7.8

7.9 Calculate the interest on the

overdrawn account. A 7.9

7.10 Calculate the Closing Balance

on 04.30 A 7.10

7.1 Write down the date and the number

of the statement. A 7.1

7.2 Why is the "Brought forward" balance

shown with a negative sign? A 7.2

7.3 Why are the amounts shown in the

Debit column shown as

negative numbers? A 7.3

7.4 Calculate the balance after

AtoZ Services paid the salary. What and

why is the sign of the Balance? A 7.4

7.5 Calculate the Balance on 04.06.

Explain your answer. A 7.5

7.6 Why is the amount shown in the

Credit column positive? A 7.6

7.7 Calculate the Balance on 04.18. A 7.7

7.8 Calculate the Balance on 04.30 after

the Service fees have been added. A 7.8

7.9 Calculate the interest on the

overdrawn account. A 7.9

7.10 Calculate the Closing Balance

on 04.30 A 7.10

|

||||||||||||||||||||||||

|

|

Study the accompanying pay-slip and

then answer the questions that follow :

8.1 Calculate Jack's earnings for

Overtime 1.5 A 8.1

8.2 Calculate the number of hours that

Jack worked on Overtime 2. A 8.2

8.3 Calculate Jack's total wages for

the month. A 8.3

8.4 Assume that Jack has this income

every month. Calculate the

Income Tax that he has to pay for

the year and the monthly deduction. A 8.4

8.5 Every month Jack has to pay 1%

of his Salary to the UIF.

Calculate Jack's contribution. A 8.5

8.6 What percentage of his Salary is

deducted for Pension? A 8.6

8.7 Calculate the total deductions. A 8.7

8.8 Calculate Jack's net wages. A 8.8

then answer the questions that follow :

8.1 Calculate Jack's earnings for

Overtime 1.5 A 8.1

8.2 Calculate the number of hours that

Jack worked on Overtime 2. A 8.2

8.3 Calculate Jack's total wages for

the month. A 8.3

8.4 Assume that Jack has this income

every month. Calculate the

Income Tax that he has to pay for

the year and the monthly deduction. A 8.4

8.5 Every month Jack has to pay 1%

of his Salary to the UIF.

Calculate Jack's contribution. A 8.5

8.6 What percentage of his Salary is

deducted for Pension? A 8.6

8.7 Calculate the total deductions. A 8.7

8.8 Calculate Jack's net wages. A 8.8

|

|||||||||||||||

Study the cah register slip alongside :

9.1 How many items were bought? A 9.1

9.2 How many plastic carrier bags

were bought? A 9.2

9.3 What is the volume of the bags? A 9.3

9.4 How many items on which VAT is

not levied, were bought? A 9.4

9.5 What is the value of the items

in 9.4? A 9.5

9.6 What is the value of the items

on which VAT is levied? A 9.6

9.7 Which packaging of eggs is

cheaper - the 18 eggs per pack

or the 6 eggs per pack. Show all

your calculations. A 9.7

9.8 What is the cost of the yellow

peaches per kilogram? A 9.8

9.9 What is the price ot tomatoes per

kilogram? A 9.9

9.1 How many items were bought? A 9.1

9.2 How many plastic carrier bags

were bought? A 9.2

9.3 What is the volume of the bags? A 9.3

9.4 How many items on which VAT is

not levied, were bought? A 9.4

9.5 What is the value of the items

in 9.4? A 9.5

9.6 What is the value of the items

on which VAT is levied? A 9.6

9.7 Which packaging of eggs is

cheaper - the 18 eggs per pack

or the 6 eggs per pack. Show all

your calculations. A 9.7

9.8 What is the cost of the yellow

peaches per kilogram? A 9.8

9.9 What is the price ot tomatoes per

kilogram? A 9.9

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||