WISKUNDE

GRAAD 12

NOG OEFENINGE

Enkelvoudige en saamgestelde rente, huurkoop.

GRAAD 12

NOG OEFENINGE

Enkelvoudige en saamgestelde rente, huurkoop.

MATHEMATICS

GRADE 12

MORE EXERCISES

Simple and compound interest and hire purchase.

GRADE 12

MORE EXERCISES

Simple and compound interest and hire purchase.

Gebruik die

formules vir enkelvoudige rente

om die waarde van elke letter, korrek tot

2 desimale plekke, indien nodig, te bereken :

om die waarde van elke letter, korrek tot

2 desimale plekke, indien nodig, te bereken :

Use the formulae

of simple interest to

calculate the value, correct to 2 decimal figures,

if necessary, of each letter :

calculate the value, correct to 2 decimal figures,

if necessary, of each letter :

| Nommer Number | Kapitaal Capital | Rentekoers Interest rate | Tydperk - jaar Duration - years | Rente Interest | Bedrag Amount | Ant. / Ans. | |

| ( R ) | ( % ) | ( jaar / years ) | ( R ) | ( R ) | |||

| 1.1 | 820 | 6 | 2 | a | b | 1.1 | |

| 1.2 | 110 200 | 8,5 | 3 | c | d | 1.2 | |

| 1.3 | 14 600 | 6,2 | 4 | e | f | 1.3 | |

| 1.4 | 118 150 | 7,8 | 5 | g | h | 1.4 | |

| 1.5 | 120 218 | 13,3 | 2,5 | k | m | 1.5 | |

| 1.6 | 820 020 | 9,8 | 1,25 | n | p | 1.6 | |

| 1.7 | 110 200 | 10,25 | 3,75 | q | r | 1.7 | |

| 1.8 | 450 | 5 | s | t | 495 | 1.8 | |

| 1.9 | 23 600 | 8 | u | v | 23 320 | 1.9 | |

| 1.10 | 720 800 | 8,5 | w | x | 919 921 | 1.10 | |

| 1.11 | 31 621 | 11,25 | y | z | 36 957,04 | 1.11 | |

| 1.12 | 820 | ab | 2 | ac | 918,40 | 1.12 | |

| 1.13 | 51 060 | ad | 3,5 | ae | 63 569,70 | 1.13 | |

| 1.14 | 616 814,42 | af | 2,25 | ag | 745 188,92 | 1.14 | |

| 1.15 | 15 861,40 | ah | 1,25 | ai | 18 538,01 | 1.15 | |

| 1.16 | 725 316 | aj | 2,5 | ak | 1 051 708,20 | 1.16 | |

| 1.17 | al | 4 | am | 42,40 | 572,40 | 1.17 | |

| 1.18 | an | 5,6 | ap | 3631,82 | 25 249,80 | 1.18 | |

| 1.19 | aq | 8,75 | ar | 5779 | 24 649,21 | 1.19 | |

| 1.20 | as | 12,5 | at | 32 976,56 | 91 601,56 | 1.20 |

Bereken die rente en die bedrag wat

uitbetaal word en dus die waarde van

elke letter, korrek 2 desimale plekke,

indien nodig :

uitbetaal word en dus die waarde van

elke letter, korrek 2 desimale plekke,

indien nodig :

Calculate the interest and the amount

paid out and thus the value of

each letter, correct to 2 decimal places,

if necessary :

paid out and thus the value of

each letter, correct to 2 decimal places,

if necessary :

| Nommer Number | Kapitaal Capital | Rentekoers Interest rate | Tydperk - jaar Duration - years | Wanneer saamgestel When compounded | Rente Interest | Bedrag Amount | Ant. / Ans. | |

| ( R ) | ( % ) | ( jaar / years ) | ( R ) | ( R ) | ||||

| 2.1 | 18 320 | 3,2 | 3 | jaarliks / yearly | a | b | 2.1 | |

| 2.2 | 58 610 | 4,8 | 1,5 | half-jaarliks / semi yearly | c | d | 2.2 | |

| 2.3 | 113 850 | 6,2 | 2 | kwartaalliks / quarterly | e | f | 2.3 | |

| 2.4 | 410 810 | 8,8 | 0,5 | maandeliks / monthly | g | h | 2.4 | |

| 2.5 | 1 220 860 | 13,5 | 0,25 | maandeliks / monthly | k | m | 2.5 | |

| 2.6 | 8 430 790 | 6,7 | 4 | jaarliks / yearly | n | p | 2.6 | |

| 2.7 | 431 360 | 21 | 3 | half-jaarliks / semi yearly | q | r | 2.7 | |

| 2.8 | 85 650 | 18 | 0,3333 | maandeliks / monthly | s | t | 2.8 | |

| 2.9 | 431 500 | 6,5 | 1,5 | kwartaalliks / quarterly | u | v | 2.9 | |

| 2.10 | 48 316 250 | 9 | 0,25 | maandeliks / monthly | w | x | 2.10 |

Vraag / Question 3.

Jan koop meubels op huurkoop en die uitstaande

John buys furniture on hire-purchase and

bedrag is R18 352. Hy moet nou rente op hierdie

the amount owed is R18 352. He must pay

bedrag

bedrag betaal. Hy sal 30 gelyke

interest on this amount. He will pay 30 equal

paaiemente betaal. Die rente wat hy moet betaal

instalments. The interest that he has to pay

moet betaal word as enkelvoudige rente teen

is calculated as simple interest at an annual

10,2% per jaar bereken.

rate of 10,2% p.a.

3.1

Wat is die rentekoers?

3.1

What is the interest rate?

3.2

Hoeveel jaar is die tydperk?

3.2

For how many years will he pay the instalments?

3.3

Bereken die rente wat hy moet betaal.

3.3

Calculate the interest that he has to pay.

3.4

Bereken die totale bedrag wat hy moet

3.4

Calculate the total amount that he has to pay

terug betaal.

for the furniture.

3.5

Bereken sy maandelikse paaiement.

3.5

Calculate his monthly instalment.

3.6

Is al die paaiemente werklik gelyk? Verduidelik.

3.6

Are all the instalments really equal? Explain

your answer.

Vraag / Question 4.

Jy wil R28 650,00 leen sodat jy meubels kontant

You want to borrow R28 650,00 so that you can

kan koop. Die bank bied jou twee opsies:

pay cash for some furniture. The bank

Die eerste opsie betaal die lening oor

offers you two options :

18 maande teen 8,5% en die rente word

The first option will pay the loan over a period

maandeliks saamgestel.

of 18 months at 8,5% and the interest is

Die tweede opsie betaal die lening oor 30

compounded monthly.

maande teen 10% en die rente word

The second option will pay the loan over

kwartaalliks saamgestel.

a period of 30 months at 10% and the

interest is compounded quarterly.

Watter is die goedkoopste opsie? Toon al

Which is the cheaper option? Show all

jou berekeninge.

your calculations.

Vraag / Question 5.

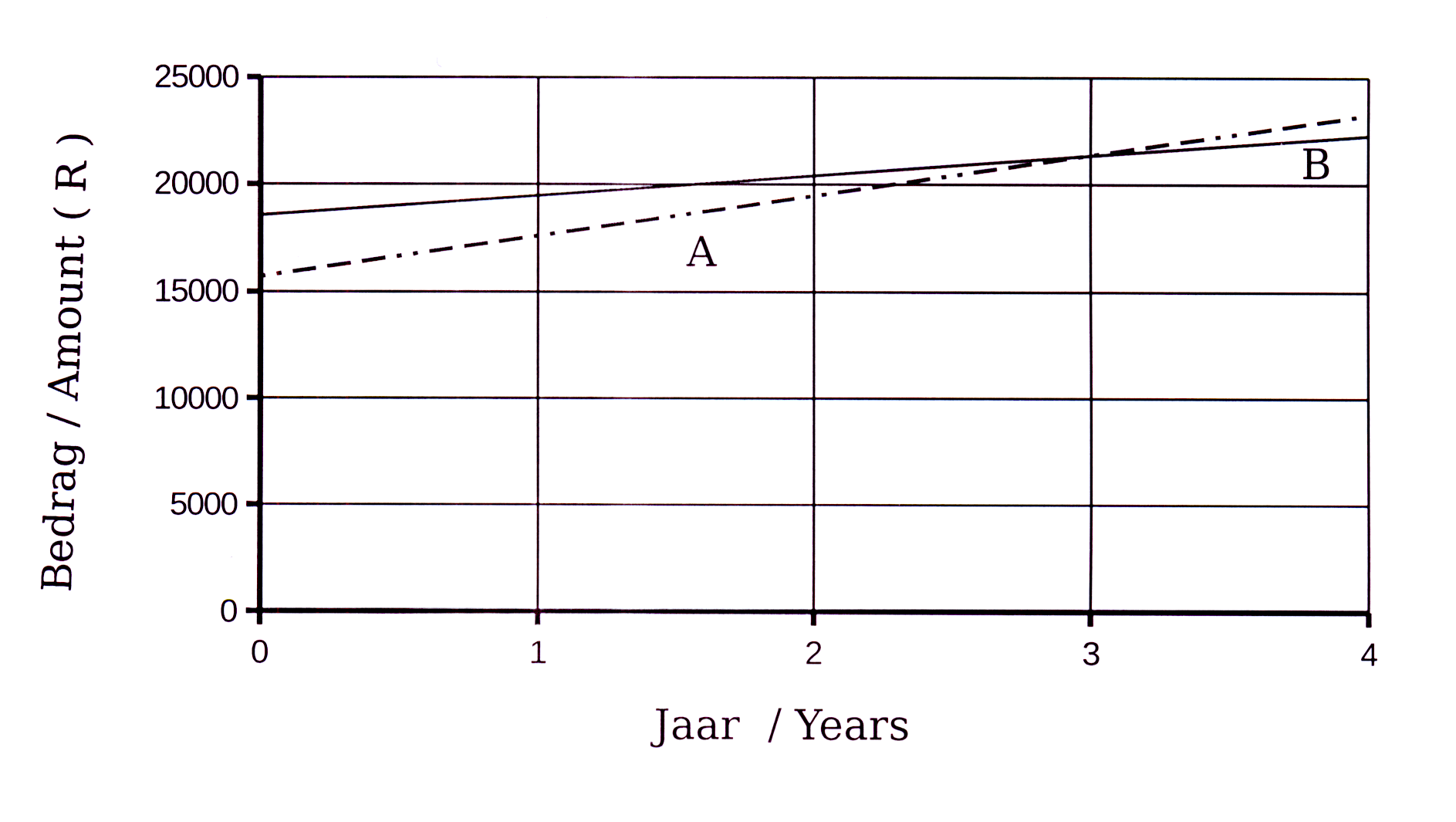

Thabo wil meubels koop maar hy het nie genoeg geld nie. Hy besluit om geld te

spaar totdat hy die meubels kontant kan koop. Hy belê R15 700 in die bank. In die diagram hieronder toon grafiek A hoedat sy

spaargeld toeneem. Terselfdertyd neem die prys van die meubels,

a.g.v. inflasie, ook toe. Grafiek B toon hoedat die meubels duurder word.

Die aanvanklike koste van die meubels is R18 550,00.

Thabo wants to buy some furniture but he does not have sufficient funds. He decides to save some money

until he can pay cash for the furniture. He invests R15 700. In the diagram below graph A shows how his savings increase.

At the same time the price of the furniture increases, due to inflation.

Graph B shows how the furniture becomes more expensive. The initial cost

of the furniture is R18 550,00.

5.1 Na hoeveel jaar het hy genoeg geld gespaar?

5.1 After how many years did he save enough money?

5.2 Die inflasie koers is 5% p.j. Wat is die prys

5.2 The inflation rate is 5% p.a. What is the price

van die meubels as hy dit kan bekostig?

of the furniture when he has sufficient funds?

5.3 Teen watter persentasie enkelvoudige rente,

5.3 At what percentage simple interest does his money

neem sy geld toe? Toon jou berekening.

increase? Show your calculations.

Vraag / Question 6.

Die prys van 'n TV stel is R2 500. Jy kan 'n deposito van R250 en 24 maandelikse paaiemente betaal. Die rentekoers is 10% p.a.

The price of a TV set R2 500. You can pay a deposit of R250 and 24 monthly instalments. The interest rate is 10% p.a.

6.1 Bereken die persentasie deposito wat jy

6.1 Calculate the percentage of the deposit that

betaal.

you pay.

6.2 Bereken die maandelikse paaiement.

6.2 Calculate the monthly instalment.

6.3 Bereken die totale bedrag vir die TV betaal.

6.3 Calcilaute the total amount paid for the TV.

Vraag / Question 7.

Peter koop 'n klanksisteem van R8 500. Hy betaal 10% deposito en die res oor 'n periode van 24 maande teen 'n rentekoers van 8% p.a.

Peter buys a sound system for R8 500. He pays a deposit of 10% and the remainder over a period of 24 months at an interest rate of 8% p.a.

7.1 Bereken die deposito wat hy betaal.

7.1 Calculate the deposit that he pays.

7.2 Bereken sy maandelikse paaiement.

7.2 Calculate his monthly instalmant.

Vraag / Question 8.

John koop 'n motor vir R95 000. Hy betaal 'n deposito van 10% en die res in 54 maandelikse paaiemente teen 'n rentekoers van 13% p.j.

John buys a motorcar for R95 000. He pays a deposit of 10% and the remainder in 54 monthly instalments at an interest rate of 13% p.a.

8.1 Bereken die deposito wat John betaal.

8.1 Calculate the amount of the deposit.

8.2 Bereken die lening wat hy maak.

8.2 Calculate the amount of the John's loan.

8.3 Bereken die bedrag van die paaiement.

8.3 Calculate the amount of the instalment.

8.4 John besluit om sy paaiement te verhoog na

8.4 John decides to increase his instalment to

R2 520,00 per maand. Hoe groot is sy

R2 520,00. Calculate the magnitude of his

laaste paaiement?

final instalment.

Vraag / Question 9.

'n Man koop meubels in 'n meubelwinkel. Die koopprys is R25 000. Hy betaal 'n deposito van 15% en 24 paaiemente. Die rentekoers is 12% p.a. Bereken die

A man buys furniture from a shop. The cost price is R25 000. He pays a deposit of 15% and 24 instalments. The interest rate is 12% p.a. Calculate the

9.1 deposito wat hy betaal.

9.1 amount of the deposit.

9.2 totale verskuldigde bedrag.

9.2 total amount due.

9.3 bedrag van die paaiement.

9.3 amount of the instalment.

9.4 koste van die meubels.

9.4 cost of the furniture.

9.5 laaste paaiement as die winkel 'n paaiement

9.5 last instalment if the shop's instalment

van R1 100,00 vra.

is R1 100,00.

Vraag / Question 10.

Peter koop meubels by 'n winkel. Die koopprys is R38 500. Hy betaal 'n deposito van 12% en 30 paaiemente. Die rentekoers is 14% p.a.

Peter buys furniture at a shop. The cash price is R38 500. He pays a deposit of 12% and 30 instalments. The interest rate is 14% p.a.

10.1 Bereken die grootte van sy paaiement.

10.1 Calculate the amount of the instalment.

10.2 Wat kos die meubels hom?

10.2 What is his total payment?

10.3 Hy besluit om 'n paaiement van R1 630,00

10.3 Peter decides to pay an instalment

te betaal.

of R1 630,00.

10.3.1 Hoeveel paaaiemente sal hy nou betaal?

10.3.1 How many instalments will he now pay?

10.3.2 Bereken die grootte van die laaste

10.3.2 Calculate the size of the final instalment.

paaaiement.

10.3.3 Wat is totale koste van die meubels nou?

10.3.3 What does the furniture cost him now?

10.3.4 Het hy gespaar? Verduidelik.

10.3.4 Did he save? Explain

Vraag / Question 11.

Peter koop meubels vir R35 000. Die deposito is 10% en die rentekoers is 15% p.a. oor 'n periode van 2 jaar.

Die winkel vra ook versekering van 18% per jaar op die totale uitstaande bedrag.

Peter buys frniture valued at R35 000. The deposit is 10% and the interest rate is 15% p.a. over a period of 2 years.

The shop also demands insurance at 18% p.a. on the total outstanding balance.

11.1 Bereken die grootte van die tekort en die

11.1 Calculate the amount of the deficit and the

rente daarop.

interest added.

11.2 Bereken die bedrag van die versekering.

11.2 Calculate the amount of the insurance.

11.3 Bereken die paaiemant wat hy moet betaal.

11.3 Calculate the amount of the instalment.

11.4 Hy besluit om 'n paaiement van R2 100

11.4 Peter decides to pay an instalment

te betaal.

of R2 100.

11.4.1 Hoeveel paaaiemente sal hy nou betaal?

11.4.1 How many instalments will he now pay?

11.4.2 Bereken die grootte van die

11.4.2 Calculate the size of the final instalment.

laaste paaaiement.

Vraag / Question 12.

Tom wil 'n huis koop.

Tom wants to buy a house.

12.1 Bank A bied hom 'n rentekoers van 9% oor

12.1 Bank A will give him a loan at an interest rate

20 jaar teen 'n maandelikse paaiement van

of 9% over 20 years at a monthly instalment

R1 560. Wat is die waarde van die huislening

of R1 560. What is the amount of the loan?

huislening wat hy kan kry?

12.2 Bank B bied 8% oor 15 jaar vir dieselfde

12.2 Bank B offers a loan at an interest rate of

bedrag. Bereken sy paaiement op

8% over 15 years for the same amount.

hierdie lening.

Calculate his monthly instalment.

12.3 Watter is die beste opsie? Verduidelik.

12.3 Which is the better option? Explain.

Vraag / Question 13.

Jan belë R15 000 teen 8% per jaar enkelvoudige rente vir 5 jaar. Na 2 jaar verander die rentekoers na 7% per jaar. Jan plaas nog R3 000 in die spaarplan. Bereken die waarde van sy belegging na 5 jaar.

John invests R15 000 at 8% per annum simple interest for 5 years. After 2 years the interest rate changes to 7% per annum. John invests another R3 000 in the savings account. Calculate the value of his investment at the end of the 5 year period.