Grade 12 - More Exercises.

Financial Documents, tariffs, rates, accounts, bills.

1.

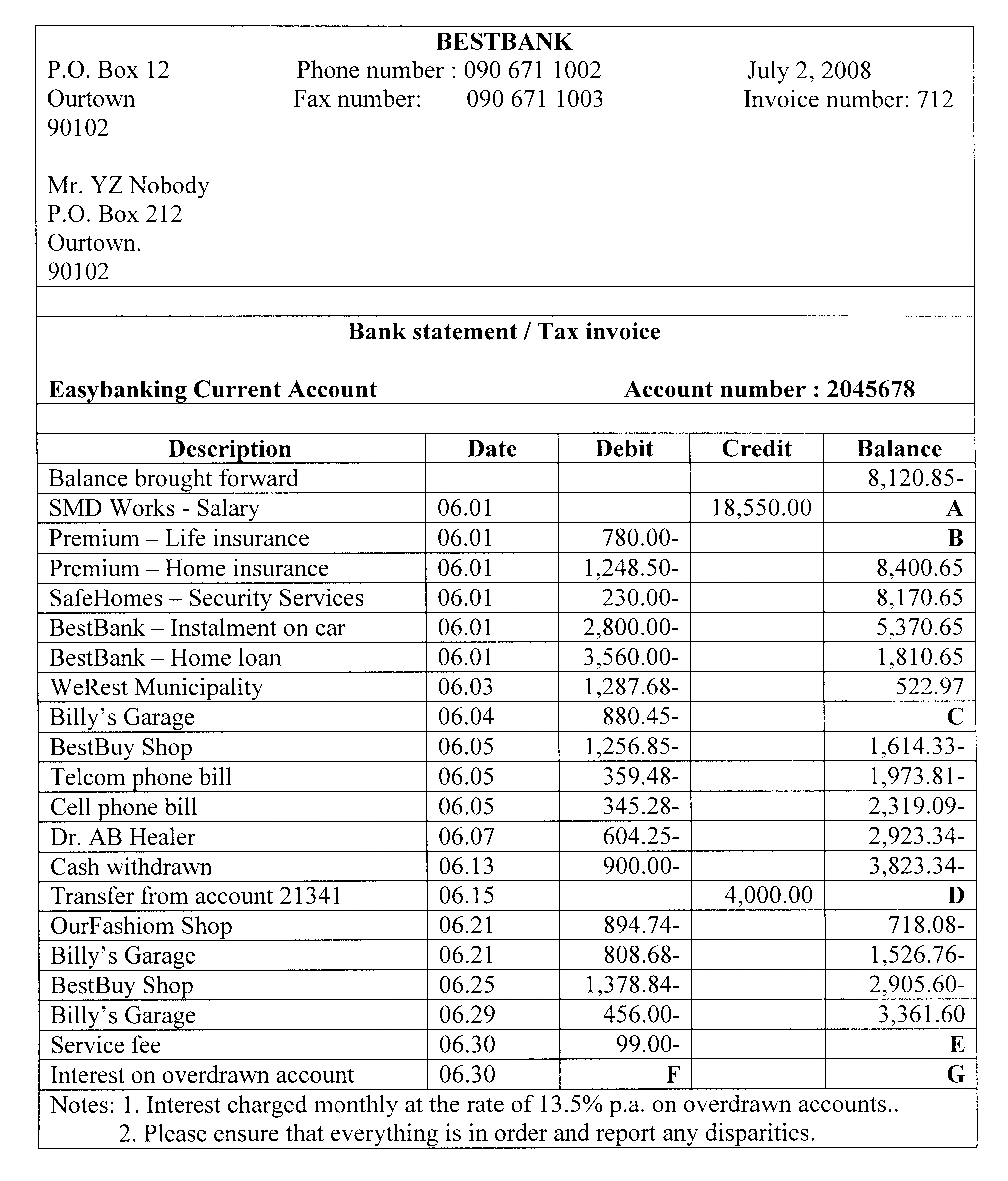

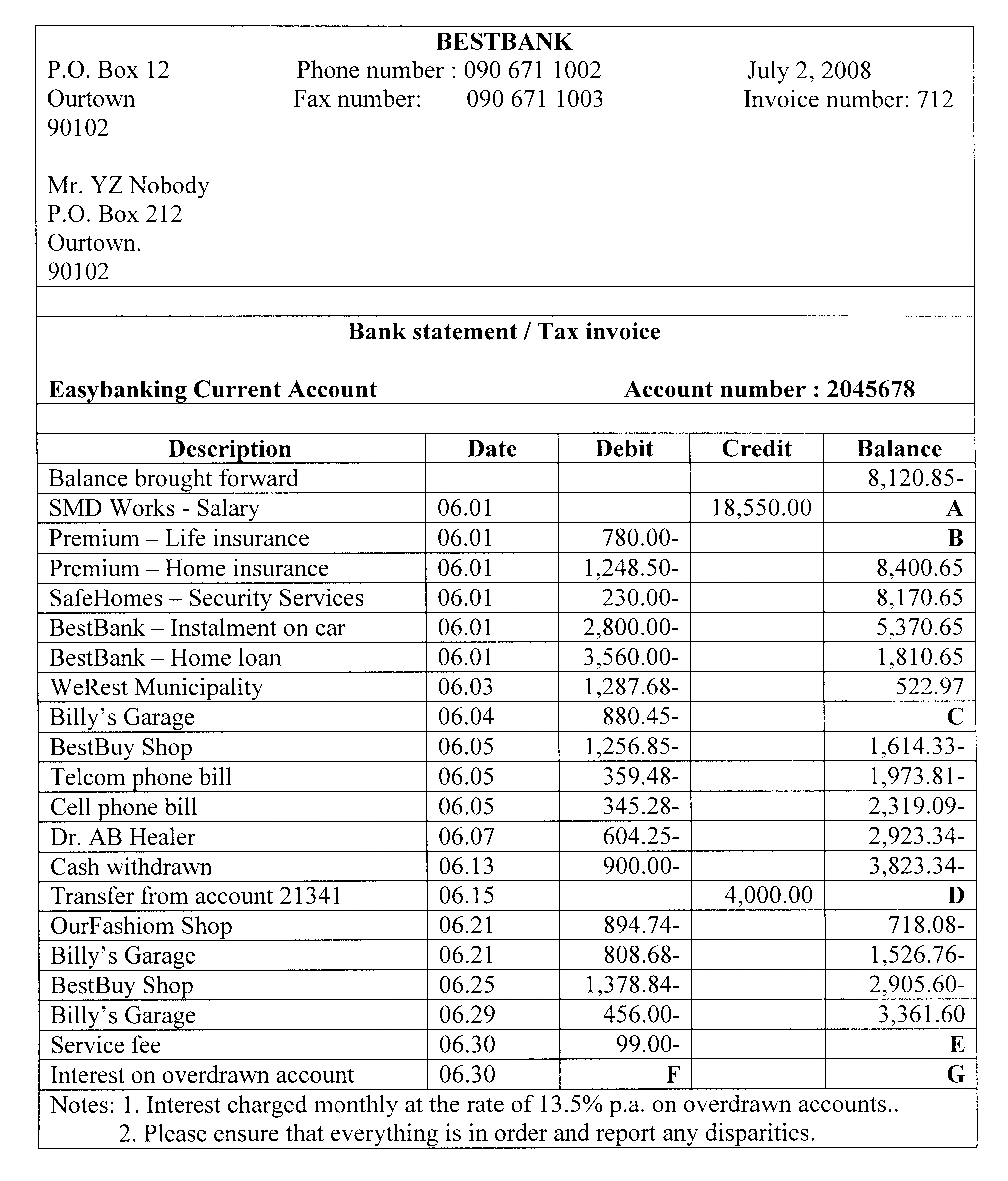

Study the accompanying Statement from the Bank and then answer the questions that follow:

1.1

What is the date of the Statement?

1.2

What is the number of the Statement?

1.3

Explain why the "Balance brought forward" is shown with a negative sign.

1.4

Calculate the balances marked A and B and explain the signs or change in sign.

1.5

Why are all the Debit entries shown with a negative sign?

1.6

How much does Mr. Nobody spend on insurance.

1.7

How much is spent on telephone bills?

1.8

Calculate the balance on 06:04. Explain the sign and meaning of your answer.

1.9

What amount is spent at BestBuy Shop?

1.10

Calculate the balance on 06:15. Explain the sign and meaning of your answer.

1.11

Calculate the balance when the "Service Fee" has been added.

1.12

Calculate the interest added.

1.13

Calculate the final balance.

2.

2.

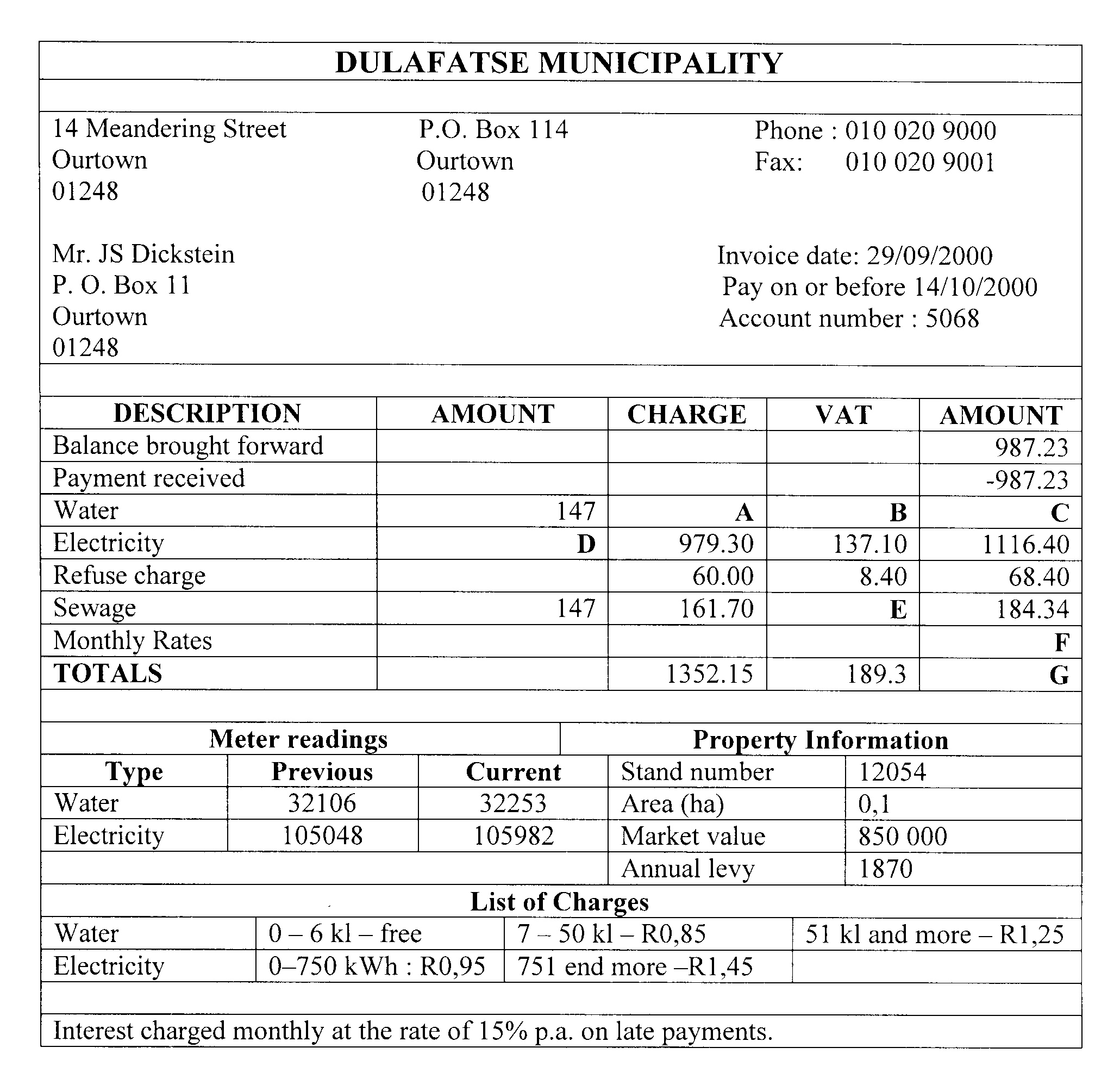

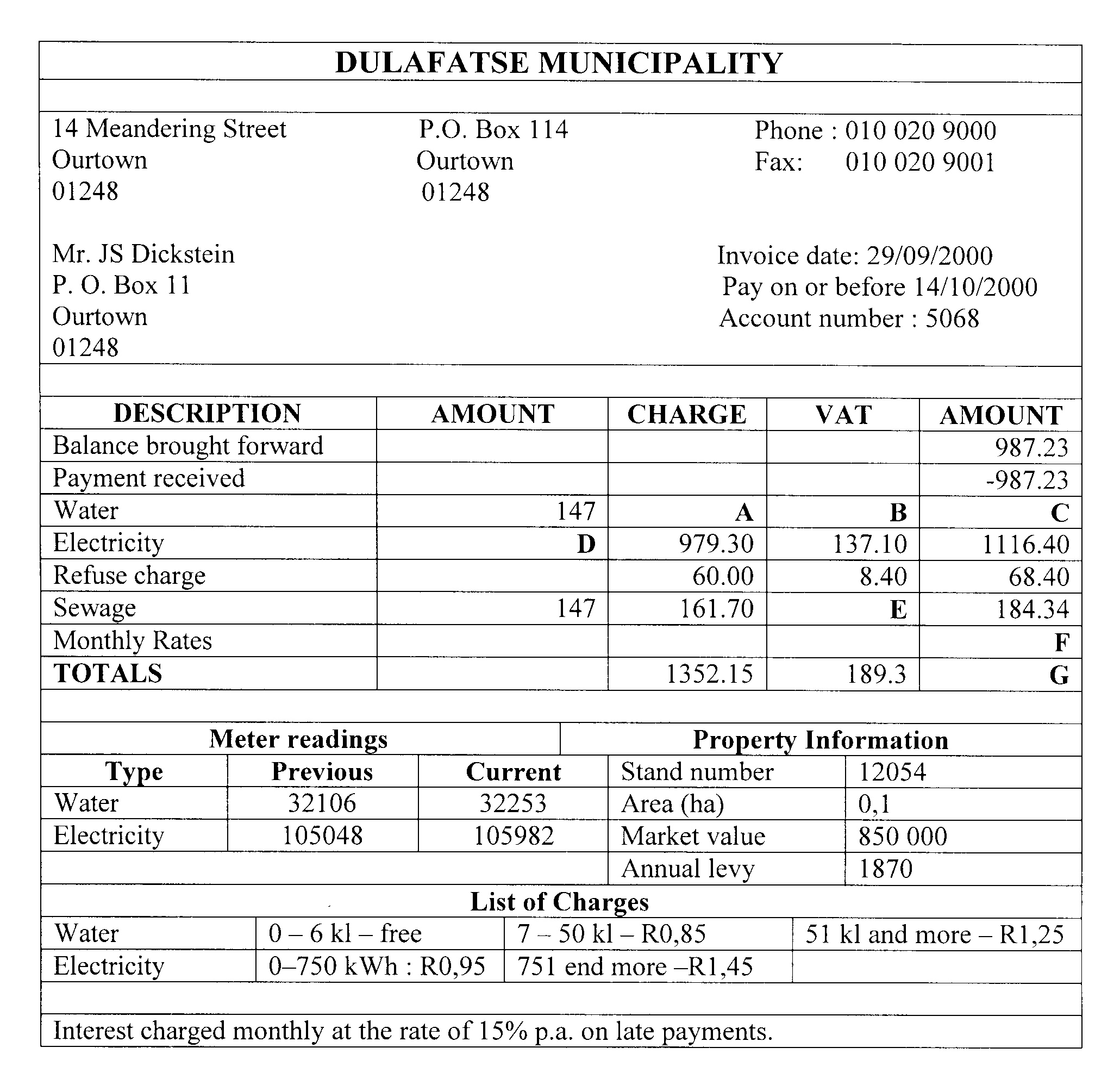

Study the accompanying from Dulafatsi Municipality and then answer the questions that

follow:

2.1

What is the physical address of the Municipality?

2.2

When is the Bill dated?

2.3

Explain why the amount "Payment received" is shown with a negative sign.

2.4

Calculate the amount that is charged for water used. Also calculate the VAT and the

total amount.

2.5

How many kWh, or units, of electricity have been used?

2.6

How much VAT must be paid on the amount for Sewage?

2.7

What are the monthly rates?

2.8

Calculate the total amount payable.

2.9

What is the last day on which Mr. Dickstein can pay the bill without incurring a penalty?

2.10

What penalty will be payable if Mr. Dickstein pays the bill on October, 21?

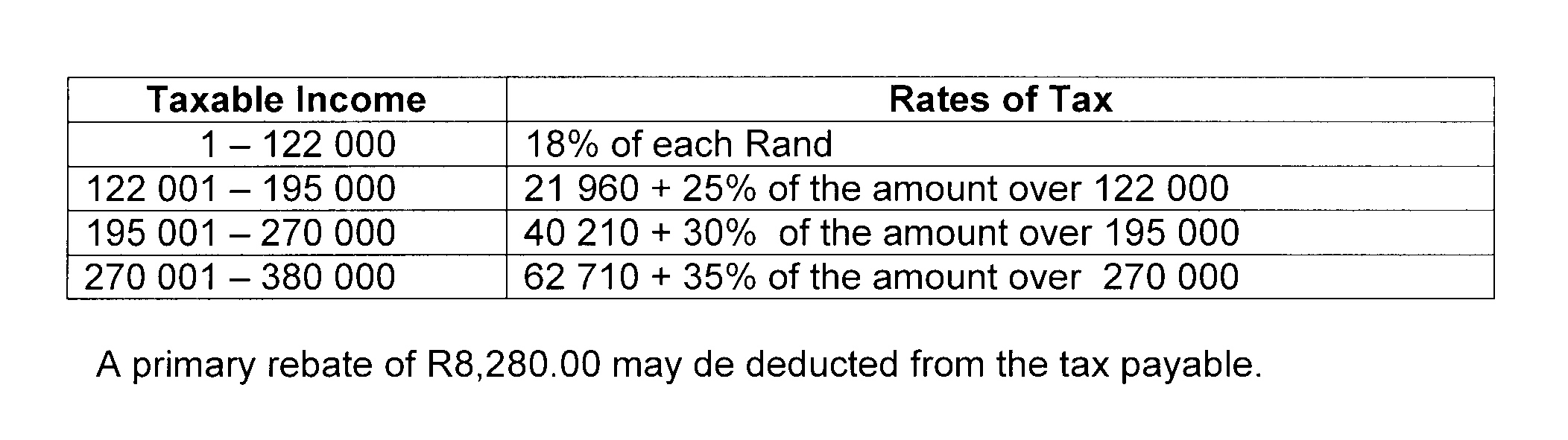

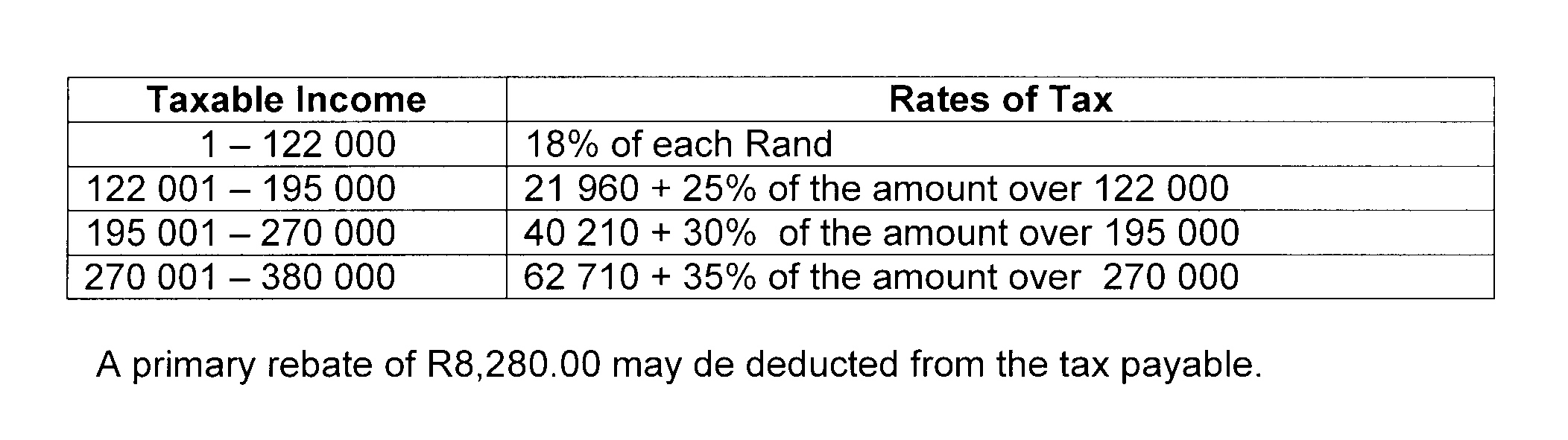

The following table is given to help you to calculate the Income Tax payable

3.

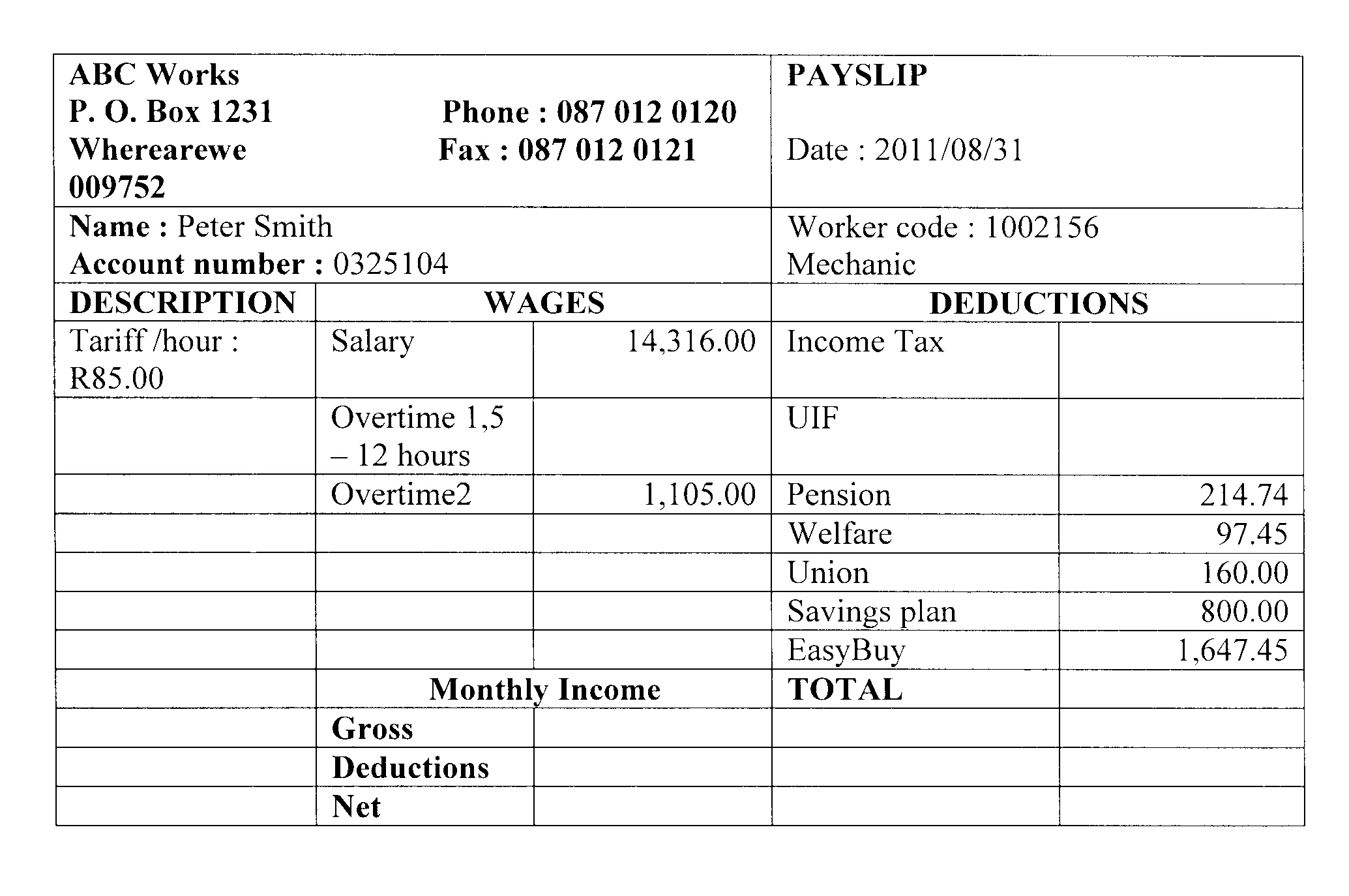

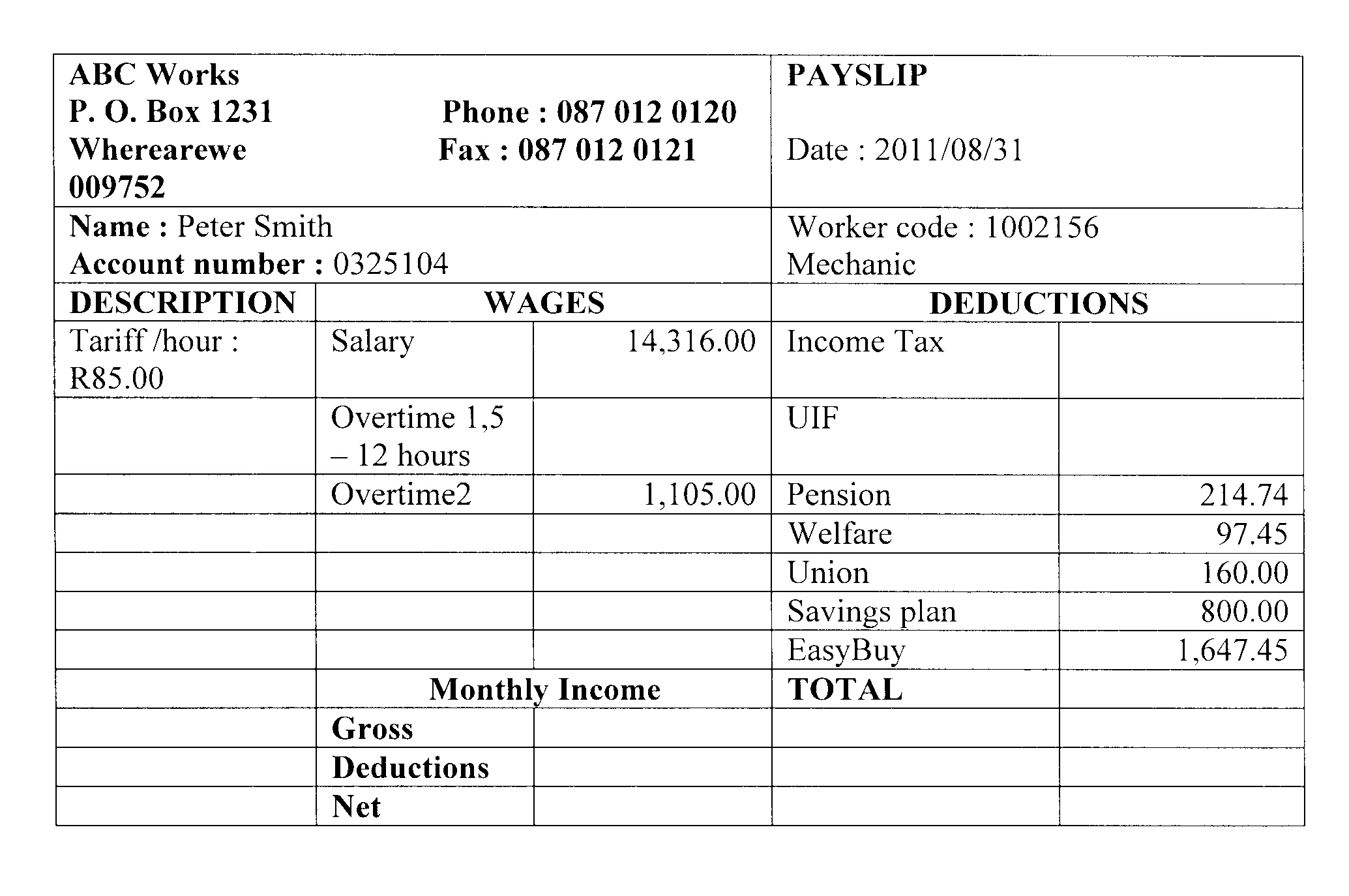

Study the following payslip and the answer the questions that follow:

3.1

Overtime 1,5 is calculated at 1,5 times the normal rate. Calculate Peter's rate for Overtime 1.5

and the value of his earnings for Overtime 1,5.

3.2

How many hours Overtime 2 did Peter work? Overtime 2 is calculated at double the normal rate.

3.3

What is Peter'e Gross income for this month?

3.4

Peter has to conribute 1% of his Gross income for UIF. Calculate his contribution.

3.5

What percentage of his salary is deducted from Peter's salary for Pension. Show all your

calculations.

3.6

Assume that Peter's Gross income each month is equal to the amount in 3.3. Now calculate

his income for the year and then calculate the amount of Income Tax payable and the amount

that will be deducted each month. Use the table given above.

3.7

Calculate Peter's income for this month.

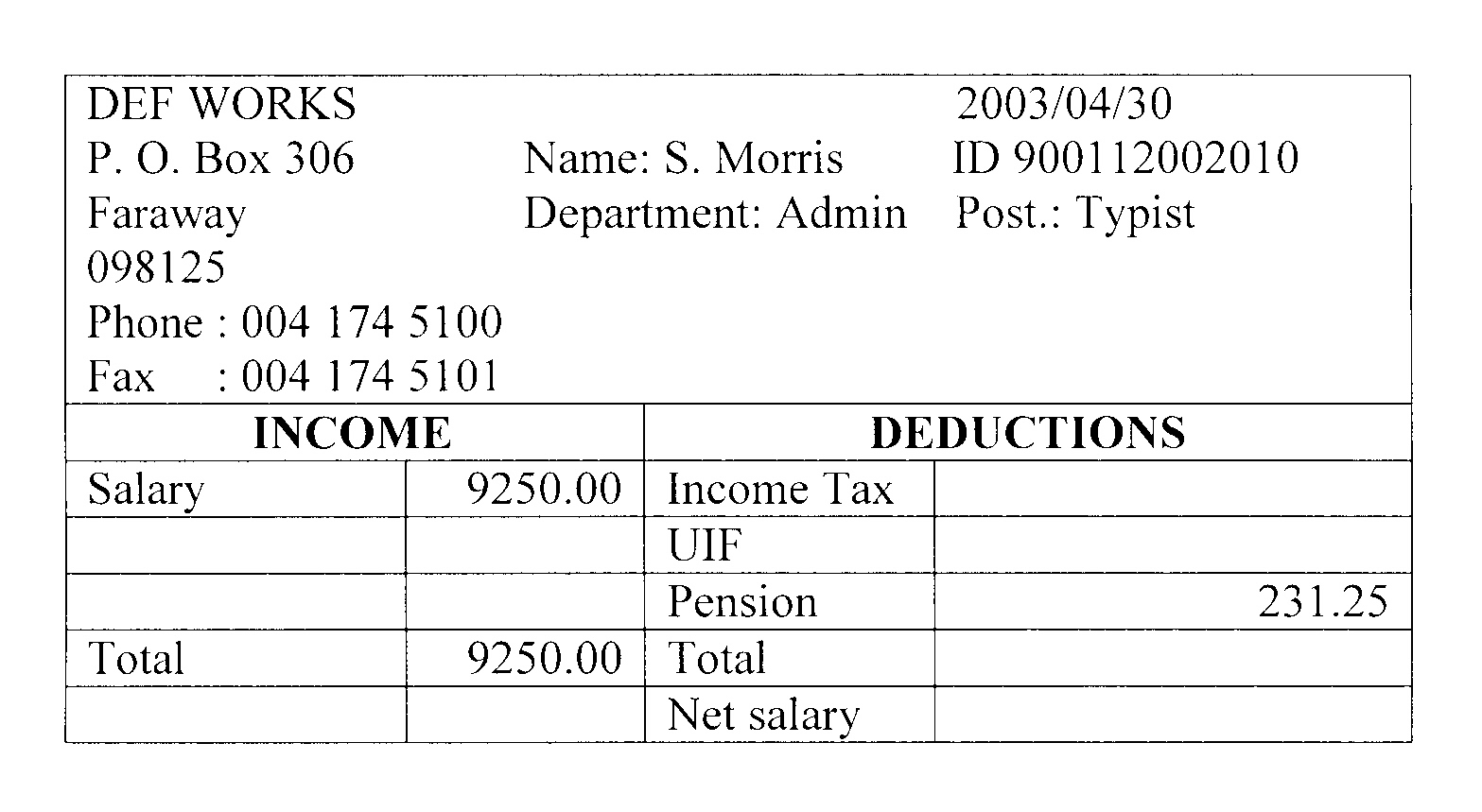

4.

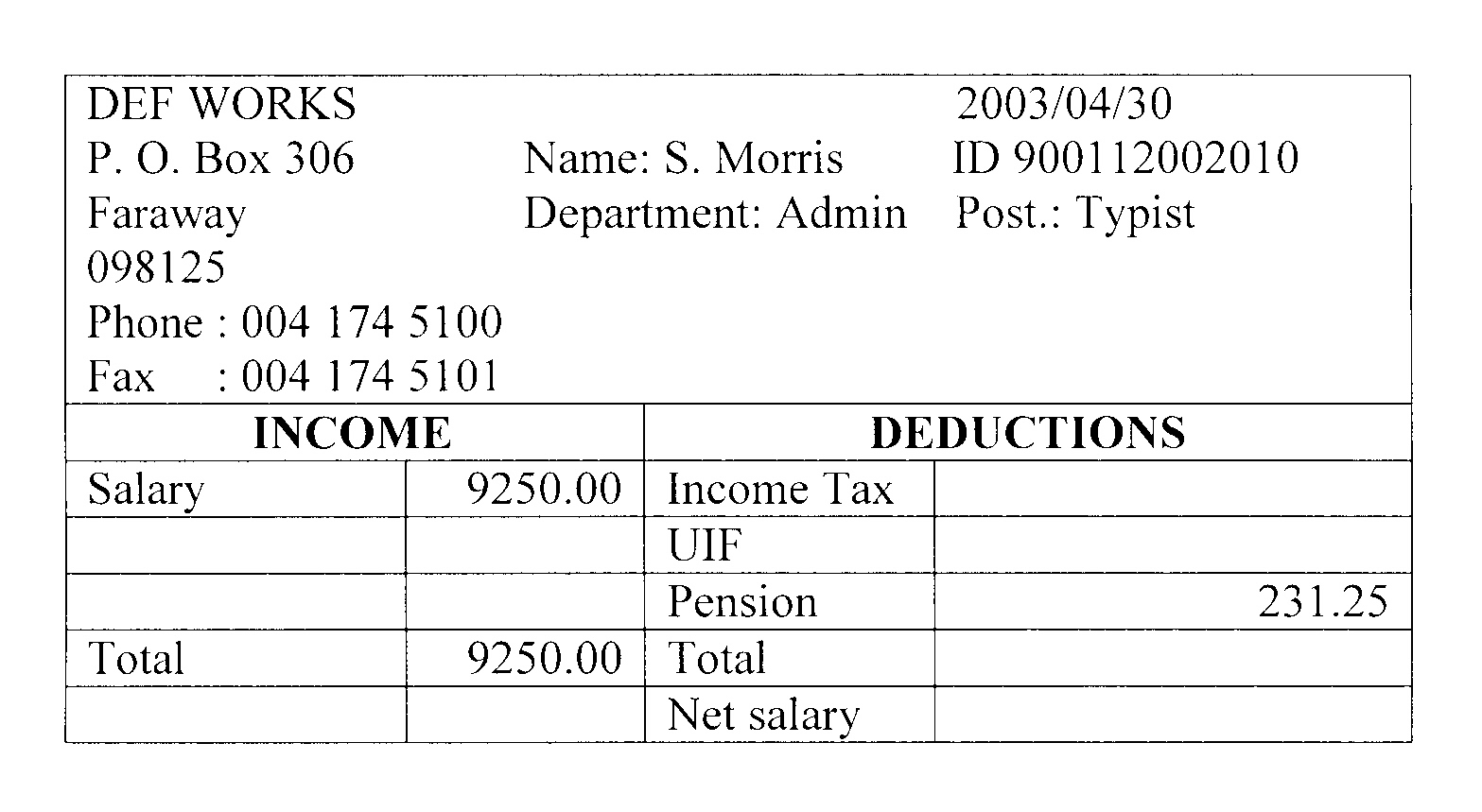

Study the following payslip and the answer the

questions that follow:

4.1

Miss Morris has to contribute 1% of her salary

towards UIF. Calculate the amount of her

contribution.

4.2

What percentage of her salary is deducted for

Pension? Show your calculations.

4.3

Calculate her annual salary.

4.4

Calculate the Income Tax that she has to pay

as well as the amount that will be deducted

each month.

4.5

Calculate her net salary.

5.1

William's annual salary is R360 000. Calculate the Income Tax that he has to pay.

5.2

John pays R4.567 Income Tax. Calculate his net monthly salary.

5.3

Peter has a monthly salary of R14 602.00. After 10 months he gets an increase in salary. His

salary is now R16,200.00. Calculate the Income Tax that he has to pay.

5.4

William's monthly salary is R15,340.00. He allows a monthly deduction of R2,600.00 for

Income Tax. Will he have pay more or will he be refunded at the end of the year? Show all

your calculations.

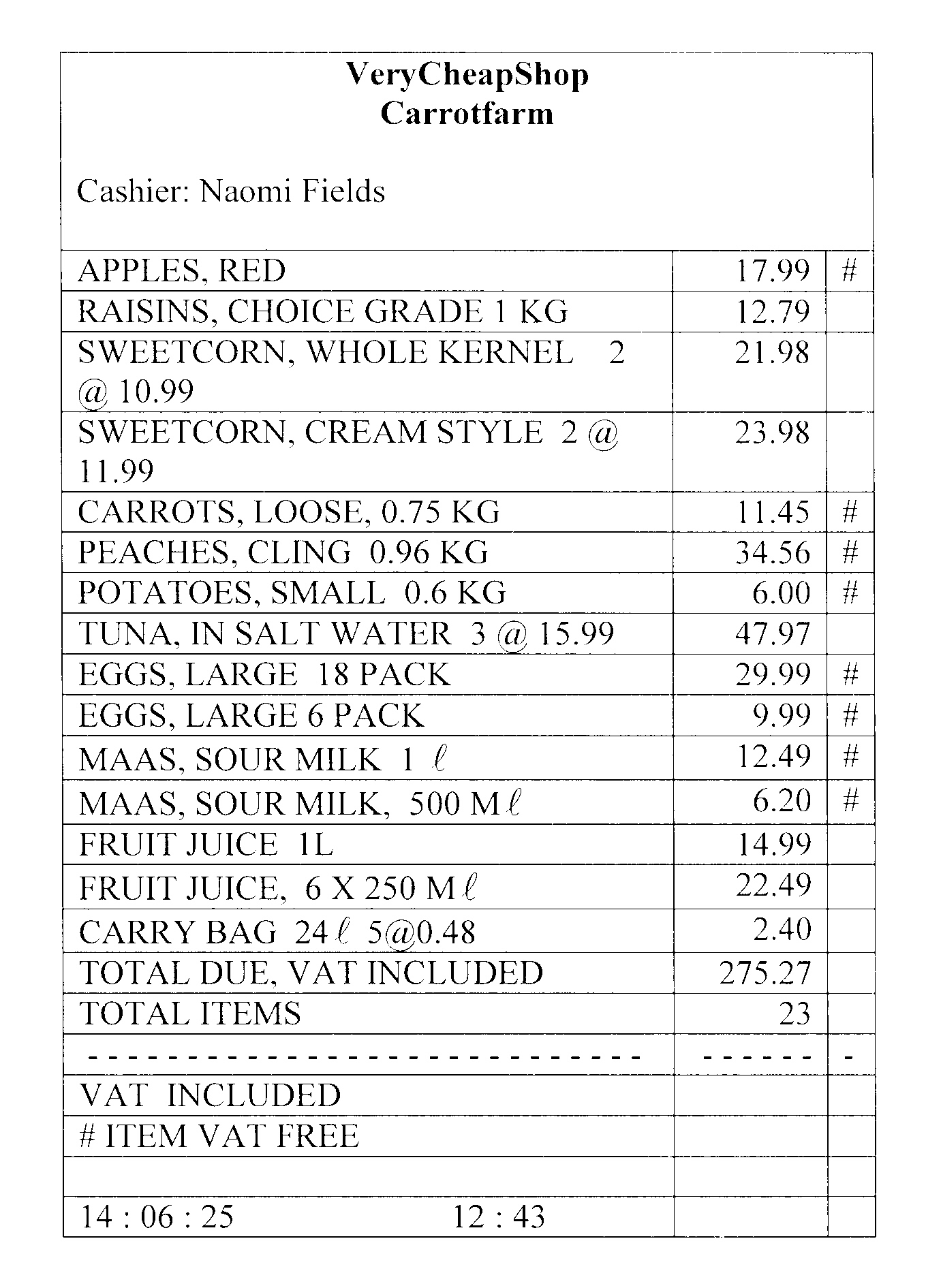

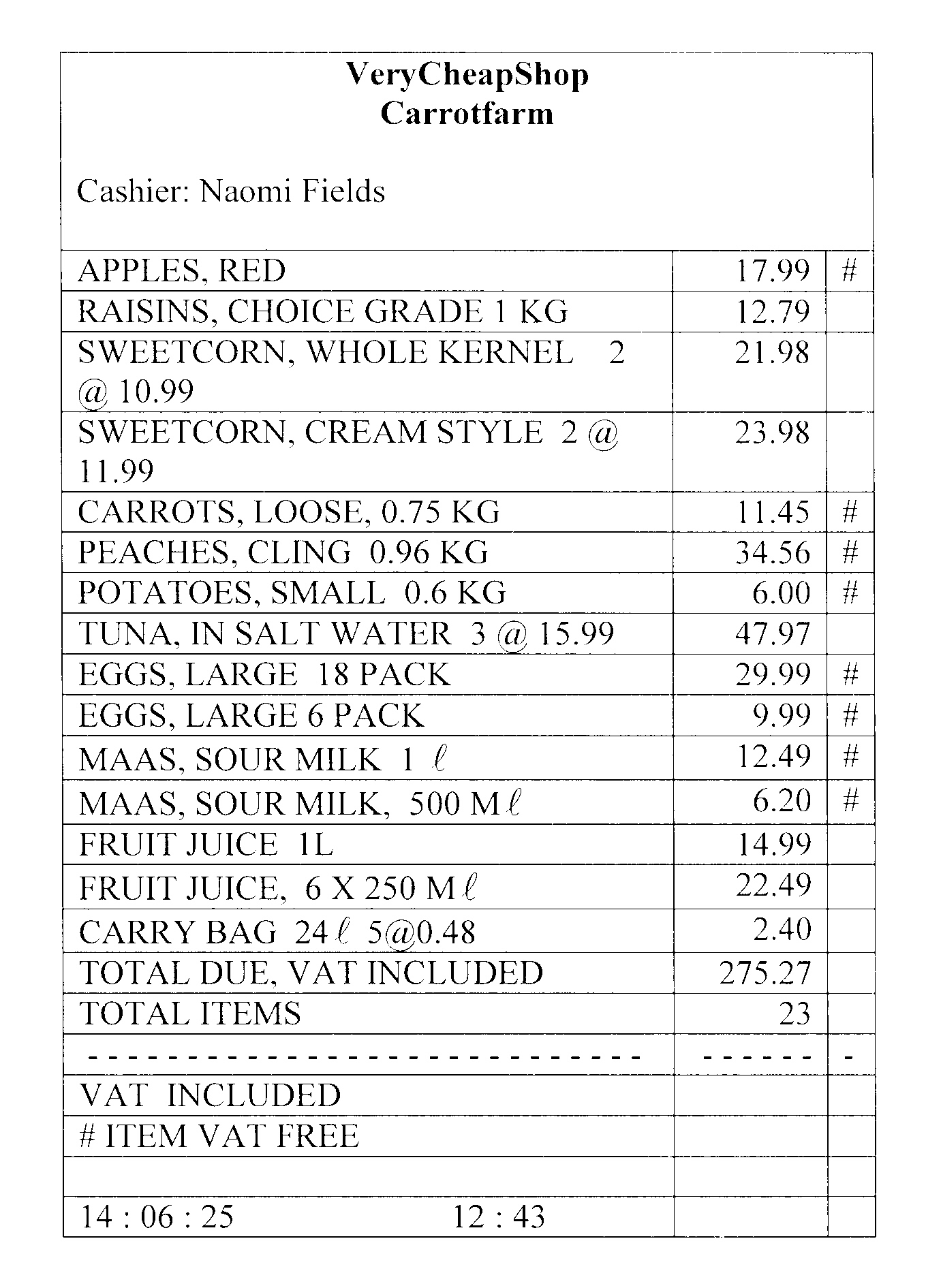

6.

Study the following cash slip and the answer

the questions that follow:

6.1

What is the name of the cashier?

6.2

How many items were bought?

6.3

What is the date of the purchases?

6.4

Why are some items marked with an "#"

What does it mean?

6.5

Calculate the price of carrots per kg

6.6

The peaches are marked R36.00 per kg.

Is it correct? Show all your calculations.

6.7

Which of the 18 pack or 6 pack of eggs, is the

cheapest?

6.8

A mother wants to give each of 10 children

150 ml of fruit juice. which package, the

6 x 250 ml pack, or the 1 l pack, will be the

cheapest per child? Show all your calculations.

6.9

Calculate the VAT payable on the items that

are not exempted from VAT.